All Categories

Featured

Table of Contents

- – Medical Insurance For Senior San Clemente, CA

- – Harmony SoCal Insurance Services

- – Best Senior Health Insurance San Clemente, CA

- – Vision Insurance For Seniors Over 65 San Cleme...

- – Cheapest Insurance For Seniors San Clemente, CA

- – Vision Dental Insurance For Seniors San Clem...

- – Senior Insurance Companies San Clemente, CA

- – Harmony SoCal Insurance Services

Medical Insurance For Senior San Clemente, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

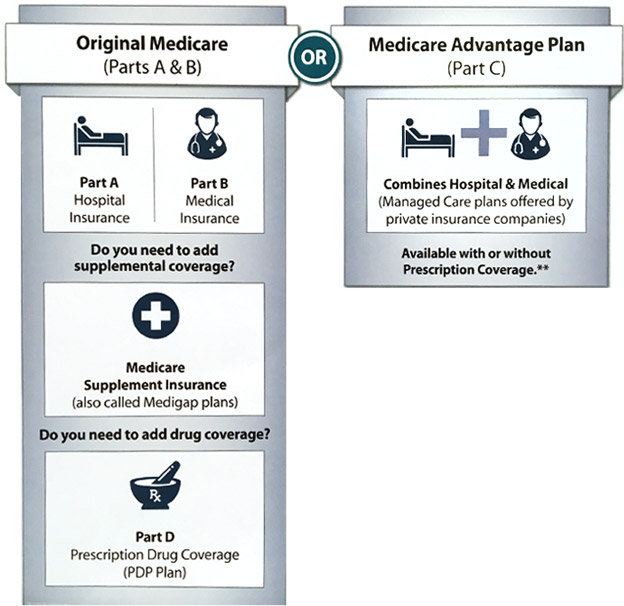

It's crucial to examine your choices at this time to make certain you proceed to have the Medicare health and medicine protection you desire. Some sorts of Medicare health insurance plan aren't Medicare Benefit Plans, but are still component of Medicare. The coverage they supply differs depending on the specific sort of plan.

Medicaid likewise covers added solutions beyond those supplied under Medicare, consisting of nursing facility treatment beyond the 100-day restriction or experienced nursing center treatment that Medicare covers, prescription medications, glasses, and listening devices. Providers covered by both programs are first paid by Medicare with Medicaid loading in the difference approximately the state's payment restriction.

* Features offered differ by strategy. *Please note, MVP is called for by law to send some plan papers by postal mail. +MVP online care services through Gia are offered at no cost-share for the majority of members. In-person gos to and recommendations go through cost-share per strategy. Exceptions exist for self-funded plans. Gia telemedicine services will be $0 after the deductible is met on MVP QHDHPs starting January 1, 2025, upon strategy revival unless the Affordable Treatment Act 2023 QHDHP/HSA secure harbor is additionally extended.

Health and wellness benefit strategies are released by MVP Health Plan, Inc., an operating subsidiary of MVP Health and wellness Care, Inc. Every year, Medicare examines plans based on a 5-star rating system.

Best Senior Health Insurance San Clemente, CA

Pay attention to this page. Best Insurance Companies For Seniors San Clemente. Your internet browser does not support the audio element. If you are a PSERS senior citizen, survivor annuitant, or the spouse or dependent kid of a PSERS retiree or survivor annuitant, and you are qualified for Medicare, you can sign up in: Medicare Supplement plan: HOP Medical Plan Worth Medical Strategy Medicare Benefit plan (Highmark, Aetna, Independent Blue Cross, Capital Blue Cross, or UPMC) If you maintain Original Medicare, you can supplement it by signing up in a Medicare Supplement strategy

Protection while taking a trip abroad is limited to solutions covered by Medicare. Keep in mind: If you tire your Medicare benefits, this strategy does not provide additional insurance coverage.

You can select a Medicare Advantage plan as opposed to Original Medicare and a Medicare Supplement strategy. Emphasizes: Strategy integrates medical and prescription medicine advantages in a solitary program. If you pick this choice, you can not register in any type of other Medicare prescription drug plan. Insurer have actually acquired with the federal government to provide Medicare advantages.

Each strategy offers just specific locations, so the plans available to you rely on where you live. You should make use of an in-network company to obtain the maximum advantage. See the regional Medicare Benefit strategy overviews for descriptions of the Medicare Advantage prepares available where you live, the advantages they give, and their prices.

Vision Insurance For Seniors Over 65 San Clemente, CA

state and government lawsMedicare's nationwide insurance coverage decisionscoverage choices made by business in each state that process Medicare claimsMedicare Part A covers hospitalization costs. This includes inpatient care in the health center, proficient nursing facility, hospice, and home healthcare. It does not include custodial or lasting care.Medicare Component Bcovers clinically needed and some precautionary solutions. People are accountable for paying a monthly premium for Component B solutions. In 2025, the conventional Component B premium is $185. This quantity may increase depending on an individual's income. Preventative solutions include treatments to avoid ailment, such as the influenza shot or tests that detect a problem at a beginning, when treatment is most reliable. Part A does not usually cover medicines, medical gadgets, or devices that.

someone needs to take home. Component B does not cover items such as: dentures and most oral careeye exams connecting to getting a prescription for glasseshearing aids acupuncture, unless it is particularly for persistent lower back painroutine foot careMedicare Benefit(Component C)is a differentto Initial Medicare(parts A and B). Personal medical insurance firms supply numerous Medicare-contractedwellnessplans that give all Part A and Part B advantages, however with some extra options.Medicare Advantage may have reduced out-of-pocket expenses than Initial Medicare. Insurance companies commonly have numbered rates, with generally suggested, reduced expense medications in the reduced rates and less typical, a lot more costly medications in greater tiers. Each rate will usually have its very own copayment quantity, with higher tiers having higher out-of-pocket expenses. A person's total expenses will rely on several aspects, consisting of which medicines they take and whether they use a pharmacy within the strategy's network. There is no one-size-fits-all choice when it pertains to choosing the very best Medicare strategy, as people have various scenarios, requirements, and concerns. Other factors to consider play a role, the decision may come.

down to weighing the evaluating benefits versatility Advantages Medicare initial the financial benefits of Advantages Advantage plansBenefit After carefully examining the benefits and drawbacks, an individual can sign up in the plan that is finest for them. As of September 2024, there were 2,951,112 Pennsylvania homeowners enlisted in Medicare. That's 20 %of the state's populace, versus concerning 18%of all U.S. homeowners signed up in Medicare. Pennsylvania has the fifth-highest percentage of citizens that are age 65 or older, so it makes sense that the state has a higher-than-average portion of residents registered in Medicare. Medicare qualification is also triggered when a person has been obtaining impairment advantages for at least 2 years (individuals with ALS or end-stage renal disease do not need to wait two years for their Medicare registration to start). Since late 2024, nearly 11%

of Pennsylvania's Medicare recipients were under 65 and eligible for Medicare as a result of a handicap(as opposed to being eligible due to their age ). There are advantages and disadvantages to either alternative, and the"appropriate"remedy is different for each individual. Volunteer counselors, educated in locations of health insurance coverage and benefits that impact Medicare beneficiaries, supply information and aid for handling insurance claims and in assessing medical insurance alternatives. Volunteer counselors do not supply legal guidance, sell, recommend, back any certain insurance policy product, agent, insurance policy company or strategy. They provide information and help so that you can make your very own choices. SHIP counseling appointments are now being held essentially, over the phone or with the help of other innovation or personally. To establish up your consultation, contact the lead in your location, or call your Area Office on Aging. NJ Save is an online application to assist low-income elders and individuals with disabilities conserve money on Medicare costs, prescriptions prices, and other living costs. SHIP generates and regularly updates charts detailing the numerous Medigap, Medicare Benefit and Component D medicine strategies supplied in New Jersey. These charts have actually been posted here to aid you contrast strategies and make an educated choice regarding which plan best fits your needs and spending plan. Please note, nevertheless, that since Medigap options and prices can change at anytime throughout the year, it is recommended you call the business you are interested in to verify the information/premiums supplied on these graphes prior to enlisting or making a protection adjustment. Ask the business you want picking just how this advantage works. SHIP provides complimentary help to New Jersey Medicare beneficiaries who have issues with, or inquiries about their medical insurance. have actually been established in all 21 areas to offer you. You can likewise contact a SHIP counselor through your. For a lot of senior citizens and retired people, the most effective wellness insurance policy strategy will certainly be through Medicare. Medicare can be complicated since it has numerous various parts, however ValuePenguin can aid you browse it. For numerous senior citizens, a terrific choice is Initial Medicare (Parts A and B)with Medicare Supplement Plan G from AARP/UnitedHealthcare (UHC)if you do not mind paying even more each month for more adaptability when it involves choosing your physician. Best general: MedicareBest overall: Medicare

Cheapest Insurance For Seniors San Clemente, CA

Best for bundled coverage: Medicare AdvantageBest for bundled protection: Medicare Benefit Ideal if you have a low revenue: MedicaidBest if you have a reduced earnings: Medicaid Medicare is the ideal health and wellness insurance policy option for seniors and senior citizens. Medicare is the most inexpensive medical insurance with the very best advantages for individuals. Original Medicare includes Component A(health center insurance coverage) and Part B( medical insurance ). With Initial Medicare, you can obtain care from 99%of the doctors in the country. In addition to Initial Medicare, you can include extra protection from exclusive health and wellness insurance policy business with a Medicare Supplement plan( also called Medigap ). One more add-on is a Medicare Part D strategy for prescription medicine protection, which is your only means to get prescription drug insurance policy with Original Medicare.(likewise called Medicare Part C)is a health and wellness insurance plan that you buy from a personal insurer. Strategies have to cover the same solutions as Original Medicare, and they normally consist of prescription medications, oral and vision. AARP/UnitedHealthcare has the best Medicare Benefit strategies for 2025 due to its affordable price, excellent protection and high levels of client satisfaction. AARP/UnitedHealthcare has the ideal combination of price, insurance coverage and high quality. The company additionally markets strategies across the country, except in Alaska. This total strong efficiency makes it the very best Medicare Advantage business. This means you're only in charge of paying$ 185 each month for Medicare Part B. AARP/UnitedHealthcare's Medicare Advantage strategies have excellent scores on, with approximately 3.6 out of 5 celebrities. That positions it among the ideal companies that sell strategies nationwide. AARP/UnitedHealthcare markets Medicare Advantage plans in every state yet Alaska. AARP/UnitedHealthcare is the best business for Medigap strategies in 2025. For the majority of people, the very best business for Medigap coverage is AARP/UnitedHealthcare. Best Insurance Companies For Seniors San Clemente. Medicare Supplement(Medigap)prepares cover much of the prices that you typically pay if you have routine Medicare. The protection you get

with an offered plan letter is the very same no matter which company you choose. Medigap prepares usually set you back greater than Medicare Advantage. You'll typically pay much less when you obtain medical care with a Medigap plan than with a Medicare Advantage strategy. This is specifically useful for senior citizens who are concerned about clinical costs increasing as they age. With Medigap, you can go to any type of physician that accepts Medicare. Plan G does not cover the annual Medicare Component B deductible, which is only$257. This implies you'll have to pay for some healthcare at the beginning of the plan year before your costs gets to that quantity. In addition to the standard protection for clinical and medical facility treatment, AARP/UnitedHealthcare strategies stand apart for the vast choice of added add-on protection. There are some exceptions to this rule. AARP/UnitedHealthcare supplies Medigap Select Plan G, which just has coverage for in-network doctors. Choosing this alternative can offer you the same insurance coverage as a conventional Strategy G but at a less expensive price. UnitedHealthcare obtains approximately 40 %fewer problems than a typical firm its dimension. Wellcare is the most effective Medicare Component D company since it offers top notch, budget-friendly coverage. The firm has reduced typical regular monthly rates, and some plans cost as little as $0 monthly. If you select Original Medicare, the only means to have protection for prescription medications is to register for a stand-alone prescription drug plan called Medicare Part D. Even the inexpensive plans normally offer an excellent value for the protection you obtain. All strategies have$0 copays for common drugs. Wellcare will likewise deliver your medications to your home at no added price to you. Wellcare Component D plans have a high average rating on And also, Wellcare has the most preferred stand-alone Component D plan in the country. Blue Cross Blue Guard has a standard of 3.5 out of 5 stars

Vision Dental Insurance For Seniors San Clemente, CA

on, while UnitedHealthcare and Aetna both have 3 stars. BCBS is one of the largest medical insurance companies in the country and has one of the biggest networks of doctors and healthcare facilities. Lots Of Blue Cross Blue Guard firms have advantages that exceed what a common health insurance plan uses. This means you can customize your protection to your one-of-a-kind requirements. Also though some strategies only cover in-network treatment, UHC's huge network of doctors provides you a lot more freedom concerning where you obtain healthcare while still remaining in the network. Medicaid is one of the most budget friendly prepare for senior citizens and retirees who have low incomes. Even if you already have Medicare, you can double enroll in both Medicaid and Medicare to decrease your medical prices. Revenue restrictions for Medicaid depend upon where you live. In 40 states and Washington, D.C., you can receive Medicaid if you gain. The restrictions are greater in Alaska and Hawaii. Senior citizens aged 65 and over that gain way too much to qualify for Medicaid may still be able to qualify if they have high medical expenses. The Medicaid invest down program allows you deduct your clinical prices from your income. You can utilize this reduced amount toget approved for Medicaid. Medicare is the most effective medical insurance for retirees and senior citizens. Elements such as price, protection, advantages and networks of physicians were made use of to contrast companies. Other sources include: Medicare Advantage prices are only for strategies that consist of prescription medication advantages. The rate analysis excludes employer-sponsored plans, Special Requirements Plans, speed strategies, approved strategies and Wellness Treatment Early Repayment Program( HCPPs). Medigap costs are based upon information for all exclusive business, using quotes for a 65-year-old female nonsmoker. By calling a Specialist at you can obtain a cost-free comparison of your employer plan with your Medicare options.

If you are not working after 65, then an Expert at can contrast all of your Medicare alternatives for you right over the phone. Citizens in Pennsylvania have the choice to enroll right into a Medicare Supplement Strategy( Medigap), Prescription Medicine Plan (Part D or PDP )or a Medicare Advantage Plan( Part C). These strategies are state-wide; definition any individual in Pennsylvania can register into one . While your costs is determined by your state, you have the ability to utilize your advantages nationwide. Medicare Supplements are non-network-based plans, implying you can see any type of physician or professional that approves Medicare. Medicare Supplement Plans are created to aid cover coinsurance, deductibles and copays. Prescription Drug Plans are stand-alone plans supplied by private insurance providers. As discussed, they can be purchased to accompany your Medicare Supplement Strategy or purchased alone to compliment your Initial Medicare Components A and B. Prescription Medicine Program are not implied to cover 100 %of your prescription expense, yet to aid reduce your prices. If you require Extra Assist spending for your prescriptions, please visit this site. Medicare Benefit Strategies are provided by personal insurer. These plans are regulated and authorized by CMS, the Centers of Medicaid and Medicare Solutions.

Senior Insurance Companies San Clemente, CA

Medicare Supplement Strategies are wellness insurance coverage policies that offer standardized benefits to function with Original Medicare( not with Medicare Advantage). These plans might cover superior deductibles, coinsurance, and copayments and might likewise cover health and wellness treatment prices that Medicare does not cover at all, like treatment got when taking a trip abroad. When you become qualified for Medicare, you might require to enlist in both Medicare Component A(Health Center Insurance Coverage)and Component B(Medical Insurance)to get full benefits from your retiree insurance coverage.

If you choose not to join a Medicare drug strategy, you'll need to have praiseworthy medicine insurance coverage to stay clear of paying a Component D late enrollment penalty. Considering that Medicare pays initially after you retire, your retired person insurance coverage is probably comparable to coverage from a Medicare Supplement Insurance Policy(Medigap)plan. You need to have Part A and Component B to elect a Medicare Benefit strategy accessed through FEHB.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

You need to have Component A and/or Part B to elect a Part D strategy. Utilize the Medicare Plan Finder to discover a Component D medication strategy and register. Or call Medicare at 1-800-633-4227, TTY individuals can call 1-877-486-2048. You need to have Part A and Component B to pick a Medicare Advantage strategy. A lot of Medicare Benefit prepares deal medicine protection. Because situation, you'll get medication insurance coverage as component of your registration. Locate strategies and enroll by utilizing the Medicare Strategy Finder.

San Clemente, CASan Clemente, CA

San Clemente, CA

Companies Near Me Seo Consultant San Clemente, CA

Companies Near Me Seo Marketing Agency San Clemente, CA

Best Insurance Companies For Seniors San Clemente, CA

Harmony SoCal Insurance Services

Table of Contents

- – Medical Insurance For Senior San Clemente, CA

- – Harmony SoCal Insurance Services

- – Best Senior Health Insurance San Clemente, CA

- – Vision Insurance For Seniors Over 65 San Cleme...

- – Cheapest Insurance For Seniors San Clemente, CA

- – Vision Dental Insurance For Seniors San Clem...

- – Senior Insurance Companies San Clemente, CA

- – Harmony SoCal Insurance Services

Latest Posts

Photographers Near Me For Wedding Laguna Beach

Hire Wedding Photographer Redlands

Camper Ac Repair Near Me Norco

More

Latest Posts

Photographers Near Me For Wedding Laguna Beach

Hire Wedding Photographer Redlands

Camper Ac Repair Near Me Norco